Background information

Where have the cool phone features disappeared to?

by Dayan Pfammatter

Switching to a new mobile phone usually works without problems these days. To ensure this also applies to banking apps, follow these tips from expert Patrick Huber.

Thinking of getting a new smartphone for Christmas or just treating yourself to one? After the autumn presentation of new devices from Samsung, Google, Apple, Xiaomi and more, you really have the pick of the litter.

Whether Android or iOS, setting up a new smartphone is almost child’s play these days. Long gone are the days when you had to transfer phone numbers from your old Nokia to the new one by hand. The data and settings from a modern smartphone are stored in a cloud and can be transferred from there to your new device. This way all your applications will work from the get-go.

Wait, all your applications? No, not all. One small group of apps is still resisting easy device switching in 2024: banking apps. A colleague recently told me about a «small crisis» when switching to a new device. You’ll also find posts like this one (post in German) across forums and on smartphone manufacturers’ help pages:

I want to get the new iPhone 15 Pro, but when I last changed from the iPhone 13 Pro to 14 Pro, I really struggled setting up my banking apps again since they weren’t mirrored 1:1 on the new iPhone (…) If this is always the case, then I’d rather do without the new iPhone 15 Pro and keep the 14 Pro!!!

On the one hand, the problem lies with banks, which offer a range of different software solutions. So says Patrick Huber, who’s very familiar with the sector. On the other hand, there are also security issues, which is why you often have to register a new smartphone with your bank before you can use it to make financial transactions.

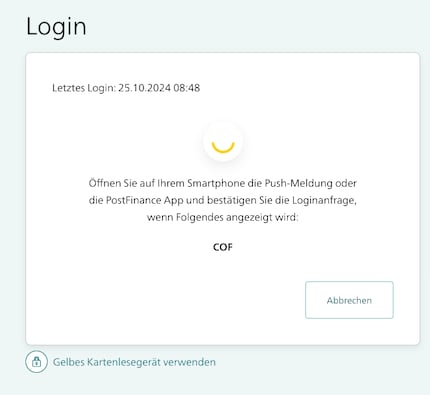

Traditional banks, such as the cantonal ones, UBS or Postfinance, offer customers the option of making payments via their websites as well as via an app or mobile site. To be sure that it really is you who’s logging in, they use two-factor authentication, or 2FA for short. For example, if you enter your login details on the website, the bank will send a push notification to the smartphone connected to your account for final approval. This prevents someone who may have been able to steal your access data from logging in since they don’t have access to your smartphone. In the past, printed TAN lists were used for verifying transactions. Later, boxes where you had to insert your bank card to generate codes popped up.

The phone number you registered for 2FA is stored in your account. If you’ve purchased a new smartphone, you have to change this in your account. These number transfers are often secured by scanning a QR code for activation. It’s usually sent to the previous smartphone, as this is the only one the bank knows for sure is yours.

Patrick Huber’s most important tip: «Keep your old smartphone and use a second cell phone!» It makes switching over much easier. If you have a new smartphone because your old one gave up the ghost or has been stolen, things become a little more complicated. Then, says Patrick, the bank’s call lines are often your best option. Of course, check at what times the phone service is even available. Even after talking to a bank employee, registration on your new smartphone isn’t done yet. This is because an activation code is normally only sent by post if a new one is required because, for example, your activation letter can no longer be found.

To make matters worse, switching smartphones works differently with almost every bank. As Patrick explains, banks each have their own IT teams, which naturally consider the solution they have the best. There have been attempts to find joint solutions, but ultimately they didn’t come to be.

UBS, Postfinance and cantonal banks are often lugging around decades of technical baggage. So-called neobanks, on the other hand, only operate in an app where you as the customer do everything. Since you don’t use a website with Yuh, Neon, Zak or Revolut – or the functions there are only very limited – login security is technically easier to solve there. As a rule, codes are used in these apps, both for logging in and for transactions.

Neobanks use a two-stage process to ensure that the customer is also the person who owns the smartphone where the app is installed. If you use a neobank, you should also protect the mobile phone you’re using. Here are some tips from the data protection officer in the canton of Zurich.

What the neobanks themselves are doing has been broken down by Patrick Huber in a longer article (in German).

Despite all the technical solutions offered by these banks, in the end people remain the biggest vulnerability, as Patrick emphasises. Many people are too careless with their data, all out of convenience. Patrick cites countless trial subscriptions as examples, as well as cases of giving away your phone number for an hour’s free Wi-Fi at the airport. This is sensitive information that shouldn’t be carelessly spread around. «You should always question and update your own security approach,» advises Patrick. Even if it entails a certain amount of effort, there are ways to leave fewer traces of data in the digital space.

For banking apps, Patrick uses his own smartphone with his private number that nobody else knows. In addition to an important e-mail address used for confidential communication, he also has other e-mail addresses for other purposes. Economical data usage is key. The idea behind this is that you leave as little data as possible online and break the data collection chain. This reduces the risk of third parties attacking you with phishing and, in the worst case, stealing your identity.

You can find further information and helpful links on changing smartphones here for Postfinance, Raiffeisen, ZKB, Berner Kantonalbank and UBS. Expert Patrick Huber provides a good overview of the process on his blog (in German).

Journalist since 1997. Stopovers in Franconia (or the Franken region), Lake Constance, Obwalden, Nidwalden and Zurich. Father since 2014. Expert in editorial organisation and motivation. Focus on sustainability, home office tools, beautiful things for the home, creative toys and sports equipment.

Interesting facts about products, behind-the-scenes looks at manufacturers and deep-dives on interesting people.

Show all